Your credit score plays a big role in your financial life. It can determine whether you get approved for a loan, what kind of interest rate you’re offered, and even if you’re considered for certain jobs or rental properties. When your score is low, the cost of borrowing goes up, and opportunities can slip away.

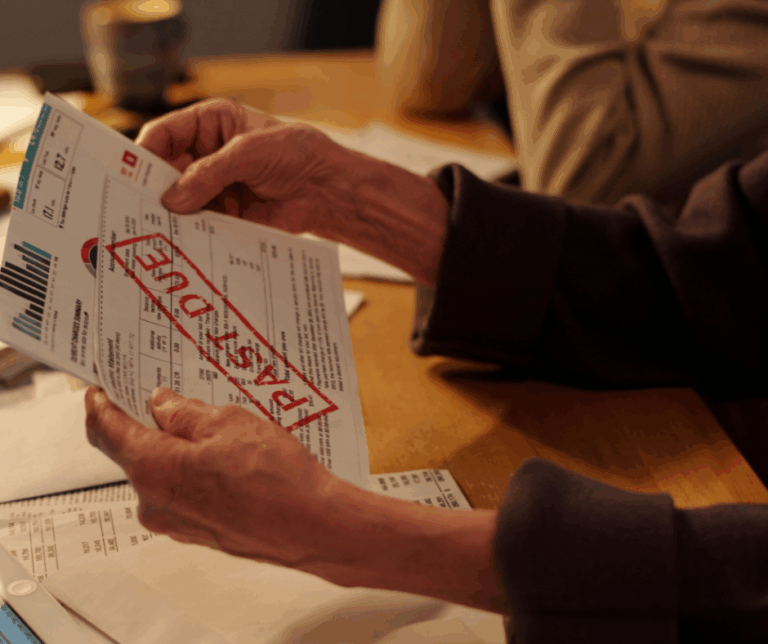

That’s why building and maintaining a good credit score is so important. But getting there isn’t always easy. Even small mistakes like missing a payment or maxing out a credit card can cause your score to drop fast. If you’ve been dealing with the stress of bad credit, credit repair can help you get back on track.

Still, many people wonder if their efforts are working. In this article, we’ll show you five clear signs that your credit repair is making progress and how to know when it’s time to get expert help.

Key Takeaways

- A rising credit score is a strong sign that your credit repair efforts are working. Even small improvements mean you’re headed in the right direction.

- The removal of negative items like late payments or collections shows clear progress. Check your credit reports regularly to track these changes.

- Getting approved for new credit, even small lines, is a positive step. It shows that lenders are starting to trust your credit profile again.

- Improved interest rates and loan terms mean your credit is stronger. As your credit health improves, borrowing becomes more affordable.

- Clean, accurate personal information builds trust with lenders. Updated reports reflect your true financial picture and support better outcomes.

Sign 1: Your Credit Score Is Going Up

One of the clearest signs that your credit repair efforts are working is a steady rise in your credit score. Even a small increase, like 10 to 20 points, shows that something is moving in the right direction.

Credit scores don’t jump overnight, but they do respond to positive changes. Paying down credit card balances, making on-time payments, or having errors removed from your report can all lead to gradual improvement.

The key is to monitor your score regularly. Use trusted platforms that update at least once a month, and track the changes over time. If you’re seeing upward movement, that’s a strong signal that the steps you’re taking are starting to pay off.

Sign 2: Negative Items Are Being Removed from Your Credit Report

Another good sign that your credit repair is working is the removal of negative marks from your credit report. These could be late payments, collections, charge-offs, or accounts that don’t belong to you.

When these items come off your report, it means your disputes or repair efforts are being processed successfully. And once they’re gone, your credit score has room to breathe and recover.

Take time to review your credit reports from all three major bureaus (Experian, Equifax, and TransUnion). If you notice fewer negative entries than before, that’s proof that your credit is starting to heal. This kind of progress often happens quietly, but it’s a powerful step toward better financial health.

Sign 3: You’re Getting Approved for New Credit

If you’ve recently applied for a credit card, loan, or financing plan and received approval, that’s a strong indicator that your credit profile is improving.

Lenders examine your credit history closely to determine whether you’re a risk. When you start getting approved—even for lower-limit cards or secured credit—it means your report is starting to reflect more trust and stability.

You may also notice you’re getting pre-approval offers in the mail or through your banking app. These offers are usually based on soft credit checks and show that lenders see you as a better candidate than before.

Sign 4: You’re Getting Better Rates and Terms

As your credit improves, lenders won’t just say yes—they’ll start offering you better deals. That might look like a lower interest rate on a car loan, a higher credit limit, or more flexible repayment terms.

When your credit score goes up, you become less of a risk in the eyes of lenders. That opens the door to offers that cost you less in the long run. For example, a small drop in your interest rate could save you hundreds or even thousands over time.

Sign 5: Your Personal Information Is Accurate and Up to Date

Credit repair isn’t just about removing negative accounts—it also involves making sure the personal details on your credit report are correct. That includes your name, address, phone number, and employment history.

Lenders use this information to verify your identity and assess your credibility. If anything looks inconsistent or outdated, it can raise red flags and slow down your progress.

When your personal information is clean and consistent across all three credit bureaus, it helps build trust with lenders. It also means the credit repair process is doing its job.

If you’ve reviewed your reports recently and noticed fewer errors or mismatches, that’s one more sign your credit is moving in the right direction.

What If You’re Not Seeing Progress Yet?

If you’ve been trying to fix your credit and haven’t noticed much change, don’t panic. Credit repair is a process, and sometimes, the progress isn’t visible right away.

Start by checking your credit reports from all three major bureaus. Look for updates, like recent payments being recorded or errors being corrected. These small changes may not move your score overnight, but they matter. They’re the foundation of long-term improvement.

Also, remember that different types of changes impact your score at different speeds. Removing one or two negative items might take a few weeks. Rebuilding a positive history, like on-time payments or lowering credit card balances, can take a few months. It all adds up over time.

If you’ve been doing all the right things—paying on time, managing your balances, checking for errors—but still feel stuck, it may be time to get help. Credit repair professionals like Kaydem Credit Help can look deeper, find issues you might have missed, and handle the back-and-forth with the credit bureaus for you.

Let Us Help You See Real Credit Repair Progress

When you come to us at Kaydem Credit Help, we begin by reviewing your full credit report to see what’s helping you and what’s holding you back. From there, we take action to remove the outdated or incorrect information, like missed payments, collections, charge-offs, or hard inquiries, that shouldn’t be there in the first place.

We also correct and update the personal details on your credit file. When your information is clean and consistent, lenders are more likely to trust your profile.

Contact us now to get started on your credit repair!

Frequently Asked Questions

How long does credit repair take?

Credit repair isn’t instant. For most people, it takes about 3 to 6 months to start seeing results. Some changes, like correcting errors, can happen sooner. Others, like rebuilding your credit history, take time. The exact timeline depends on what’s in your report and how consistent you are with the process.

How does credit repair work?

Credit repair starts with a full review of your credit reports. From there, inaccurate or outdated items like late payments, collections, or duplicate accounts are disputed and removed when possible. The process also includes fixing personal information and helping you build new, positive credit habits that support long-term improvement.

How do I repair my credit fast?

To speed things up, start by paying down your credit card balances, making every payment on time, and checking your reports for any errors you can dispute. While there’s no instant fix, working with a professional credit repair team like Kaydem can help you avoid delays and take the most effective steps first.