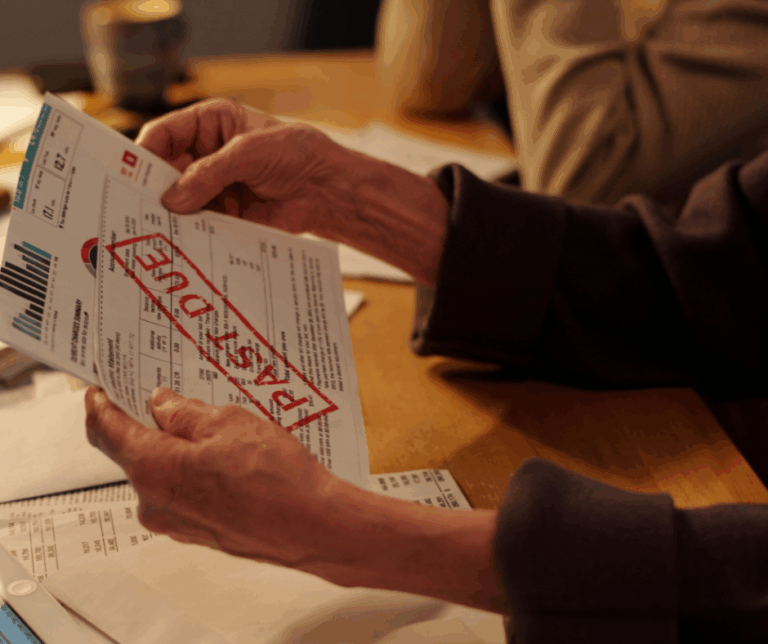

The holidays are meant to be joyful, full of laughter, giving, and connection. But for many people, the season also brings financial stress. Between gifts, travel, parties, and decorations, it is easy to spend more than you planned.

What starts as good intentions can quickly turn into maxed-out credit cards and January regret. But it does not have to be that way.

You can celebrate the holidays and make memories without wrecking your credit or going into debt. Here is how to enjoy the season and stay financially confident at the same time.

Why Holiday Spending Hurts So Many People Financially

Every year, millions of people end the holidays with more debt than they started with. The reasons are easy to understand:

- Emotional pressure: We want to give generously and make loved ones happy.

- Social expectations: Office parties, Secret Santas, and travel all add up.

- “I will pay it off later” thinking: Swiping now and worrying later often leads to lingering balances.

The problem is that overspending does not just strain your budget; it can hurt your credit score too. High balances increase your credit utilization ratio (the percentage of available credit you are using), which can lower your score even if you make on-time payments.

The good news is that a little planning and mindfulness can keep your credit, and your peace of mind, intact.

Start with a Realistic Budget

Before you buy a single gift, take a moment to figure out what you can truly afford this season.

- Make a full list of expenses. Include gifts, food, travel, decorations, wrapping supplies, and any events you plan to attend.

- Set a total spending limit. Be realistic about what fits comfortably within your monthly budget.

- Use cash or debit whenever possible. When you physically see the money leave your account, you are less likely to overspend.

- Track everything. Apps like Mint, YNAB, or even a simple spreadsheet can help you stay on target.

Think of your budget as a gift to your future self, one that prevents stress when the credit card bills arrive in January.

Be Smart About Using Credit

If you use credit cards for holiday shopping, do it strategically.

- Only charge what you can pay off in full. Avoid carrying a balance into the new year.

- Keep utilization below 30%. If your limit is $1,000, aim to keep your balance under $300.

- Skip unnecessary store cards. Those “instant 20% off” offers come with hard inquiries that can ding your score and high interest rates that cost you more later.

- Pay early if you can. Making payments before your statement closes can lower your reported balance and improve your credit utilization.

Used wisely, credit can be a helpful tool, not a trap.

Get Creative with Gifting and Celebrating

Holiday magic does not come from how much you spend; it comes from the memories you create.

- Give meaningful, low-cost gifts. Homemade treats, framed photos, or personalized letters are heartfelt and affordable.

- Host experiences instead of exchanges. Organize a family dinner, movie night, or cookie swap instead of buying multiple gifts.

- Start a gift exchange. Instead of buying for everyone, draw names so each person buys just one thoughtful gift.

- Focus on time, not things. Volunteering together or spending quality time with family costs nothing but means everything.

The best part is that these ideas not only save money but often make the holidays feel more genuine and memorable.

Plan Ahead for Next Year

If you have ever promised yourself, “Next year will be different,” here is how to make that happen.

- Create a holiday savings fund. Open a separate account and set up automatic transfers, even $25 a month adds up.

- Use rewards points or cash back. Redeem them for gifts, flights, or hotel stays next year.

- Shop early. Buying gifts throughout the year spreads out costs and avoids last-minute spending sprees.

Planning ahead helps you enjoy the season without the financial pressure that often comes with it.

How Kaydem Credit Help Can Support You

Even with the best intentions, past holiday debt or credit mistakes can linger. If you are still carrying balances or struggling with credit score drops from previous seasons, Kaydem Credit Help can help you get back on track.

Our team works with clients to identify errors, dispute inaccuracies, and build a personalized credit repair strategy. We have helped thousands of people improve their credit profiles and create a stronger financial foundation for the future.

When your credit is healthy, you have options such as better interest rates, easier approvals, and less stress when life gets expensive.

Make This Holiday Season Stress-Free, Financially and Emotionally

The holidays should be about connection, not credit card balances. By setting a plan, spending mindfully, and keeping your credit in check, you can celebrate fully without the financial hangover that often follows.

This year, give yourself the gift of peace of mind. Enjoy the holidays, protect your credit, and step into the new year on solid financial ground.