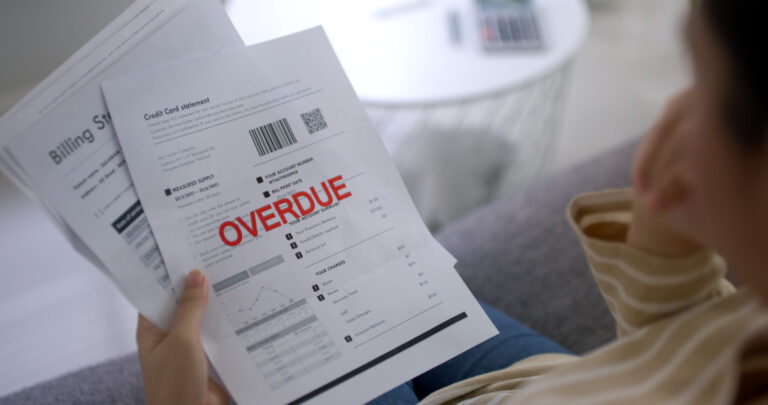

Money is one of the most frequent causes of stress in people’s lives. Which is probably why you are looking for credit repair fast. It can be hard to keep track of and manage your finances, but you must do everything possible to stay on top of your money.

Failing to manage your money effectively can lead you to rack up credit card debt, take out unnecessary loans, and damage your credit score. If you’re careless, you can find yourself in a precarious financial scenario that you could have prevented.

These four tips will help you master your finances and manage your money more effectively.

How to Master Your Finances for Credit Repair Fast

Create a budget

Making a budget is the first and most crucial step to take when it comes to money management. You need to know where your money is going to make informed decisions about how to best use it. Creating a budget allows you to clearly understand your income and expenses and make adjustments as needed.

One of the best ways to create a budget and save money is to identify and eliminate unnecessary expenses. Start by closely examining your spending habits and determining which costs are necessary and which could be cut. For example, you may consider cutting back on eating out, shopping, or entertainment expenses. Then, create categories for your expenses and give each category a budgeted amount. Be sure to include fixed costs like rent or mortgage payments and variable costs like food and transportation. Finally, review your budget regularly and make changes as needed.

Even though setting up a budget is the first step toward better money management, it will be ineffective if you fail to change your spending habits. For example, try cooking at home more often if you eat out frequently. If you struggle with impulsive buying, list the things you need before you visit the store and stick to them.

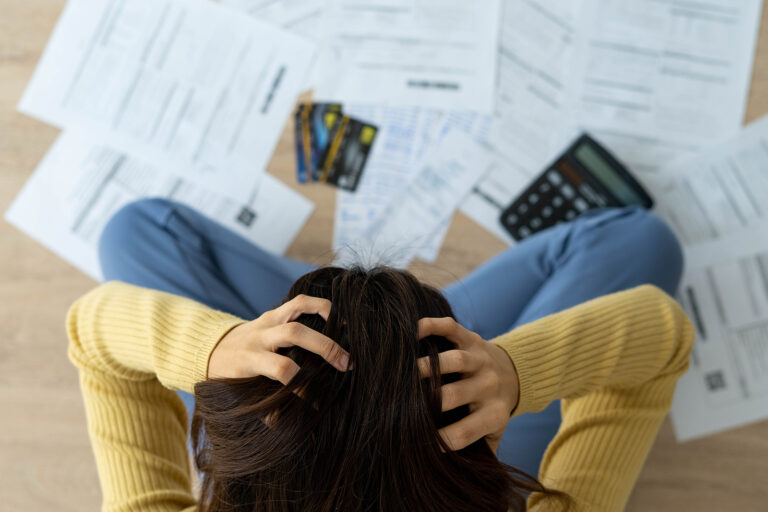

Live below your means

Living below your means is another key to money management. This means spending less than you earn and saving the rest. This may mean cutting back on luxuries or non-essential items, such as entertainment, dining out, and shopping.

Another way to live below one’s means is to make wise choices regarding housing and transportation. For example, opting for a smaller home or renting instead of buying can help save money. Similarly, choosing a less expensive car or taking public transportation can be helpful. This will enable you to store money for future objectives or cover unforeseen costs.

Invest your money wisely

Many people think that the only way to stay on top of their finances is to save their money. While saving is important, it is not the only way to manage your money. Another way to stay on top of your finances is to invest your money wisely. This can include investing in stocks, mutual funds, or other investments. Doing this can help you grow your money over time and reach your financial goals. When done correctly, investing can make your money work for you. However, it is imperative to do your research before investing any of your hard-earned money.

There are many different investment options available, but not all are right for everyone. Remember to speak with a financial advisor to get started on the right foot. With a little bit of planning, investing can help you achieve your financial goals.

Plan for the future

Finally, planning for the future is a crucial part of money management. This means setting aside money each month for retirement, unexpected expenses, and other long-term goals. Creating and adequately utilizing an emergency fund will also come in handy and is a positive money management practice.

For example, if you know you’ll need to replace your car in the next few years, start setting money aside now so you can pay for it in cash. By planning for future expenses, you can avoid taking on debt and putting yourself in a difficult financial situation.

Proper money management is essential to financial success. You can make a strategy to improve your financial condition by using the advice provided above to help you get a better handle on your finances. Start taking control of your money today, and you’ll be on your way to credit repair fast.