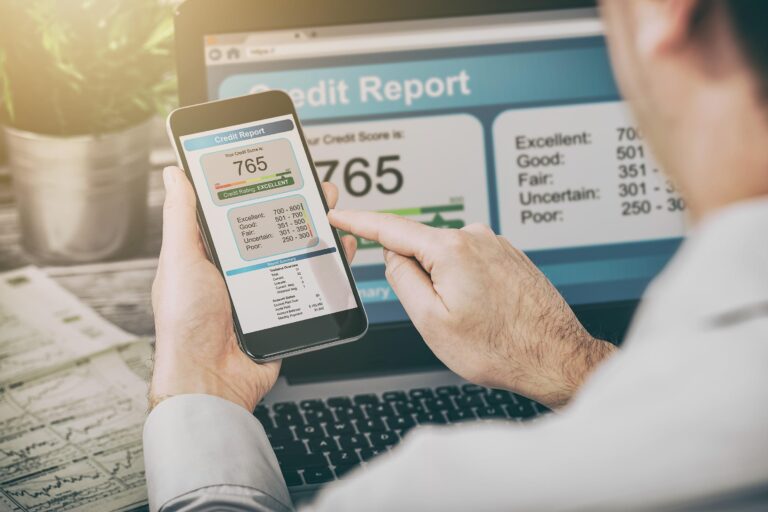

The 5 Factors That Make Up Your Credit Score – And Which Ones Matter Most

Your credit score shapes your financial opportunities. Whether you’re applying for a loan, hunting for an apartment, or just trying…

Your credit score shapes your financial opportunities. Whether you’re applying for a loan, hunting for an apartment, or just trying…

If you’ve been trying to improve your credit score, you’ve probably heard the terms “credit repair” and “credit building” –…

Credit cards can be powerful tools – or dangerous traps. The difference lies in how you use them. For many,…

Mistakes on your credit report can quietly mess with your finances. One wrong detail could lead to a loan rejection,…

Your credit score plays a big role in your financial life. It can determine whether you get approved for a…

You keep hearing how important your credit report is, but when it comes to actually checking it, the process feels…

A lot of people go through major financial decisions, like applying for a car loan or trying to buy a…

In neighborhoods across the country, people are dreaming a little bigger this year. Someone’s trying to buy their first home….

What is the Equal Credit Opportunity Act, and why does it matter? At its core, this landmark legislation ensures fairness…

If you’ve ever checked your credit card statement and noticed a negative amount applied to your balance, you’ve likely encountered…